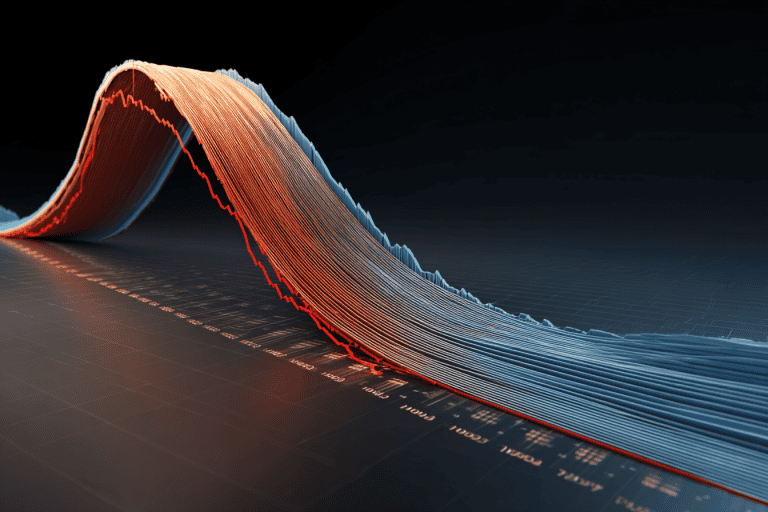

Yield Curve Strategies: Steepeners, Flatteners, and More

Expert guide to yield curve trading: steepeners, flatteners, butterflies. Learn instruments, risks & execution strategies. Introduction: Decoding the Yield Curve for Strategic Advantage The Yield